I started writing this three-part series in February about trends affecting the IT nearshoring industry. We at East have a somewhat unique place in the IT market, with a good pulse on the Nordic enterprises along with scaleups buying IT services and software development companies in Eastern Europe — and some of the surrounding countries.

This part #3 got delayed primarily due to the atrocious unlawful attack of Russia on Ukraine. I had a good portion of part three written already, flagging war as one of the biggest potential black swan events that might touch the IT industry. And unfortunately, it was realized. I felt that writing about global and macro issues for our industry before this would’ve been both tоne deaf and also premature, following the start of the war. And already during this half-year period, we’ve seen the beginning of a big market movement. Read on to learn about our observations.

This post is not only about geopolitics but also looks at other global trends and potential disruptions coming from the technology itself.

Please note that, instead of linking directly to the sources with data and research, we decided to put them, in the end, this time. Do have a look once finished, there is plenty of interesting further reading.

If you missed two previous parts of this series you can find them here:

Part #1 – Increase in demand and IT talent shortage

Part #2 – Changing roles and behavior in the market

10. Russia’s attack on Ukraine — How does it reflect on the nearshoring market?

Since the start of the war, we’ve seen how it has affected the industry, through the requests, we help to fulfill, and the situation of software development providers. The effect of the ravaging war is naturally one of the themes for this article, but not the only one – there are many other macro trends and possible turn-point events that can have a huge impact on the nearshoring and outsourcing IT markets.

The Ukrainian outsourcing market has been, and still luckily continues to be, big and significant to clients worldwide. Almost all Ukrainian companies continue to operate despite the war and have on their part contributed greatly to the war effort.

To understand the changes, it’s good to look at some raw numbers to understand the nearshoring market’s movements.

Nearshoring markets in Eastern Europe (The following countries were included in the calculation: Russia, Poland, Ukraine, Romania, Czech Republic, Hungary, Belarus, Bulgaria, Croatia, Serbia, and North Macedonia) have roughly 1.6M IT professionals. If you count out Russia and Belarus and roughly 150,000 developers from Ukraine, the availability of talent in Eastern Europe has decreased by almost 40%.2, 4, 10, 11, 17, 19, 21, 24, 25 It is no wonder, that this creates a huge surge in demand for the remaining markets.

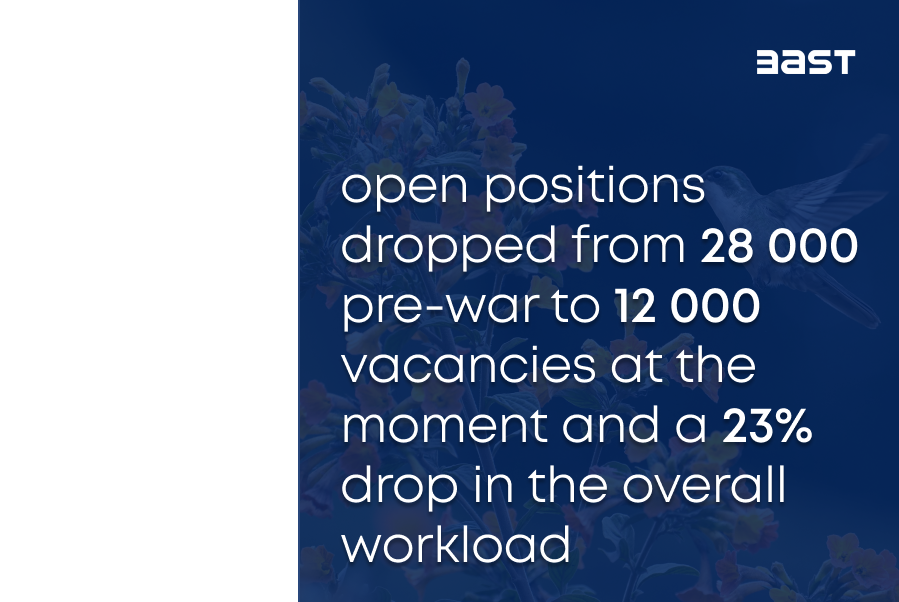

We can also observe a clear drop in the Ukrainian IT developer market demand, as the number of open positions has dropped from 28 000 pre-war to 12 000 vacancies at the moment and a 23% drop in the overall workload.6 Despite that, 77% of the Ukrainian companies have managed to retain their relationships with their clients without decreasing the volume of business.7

We can also observe a clear drop in the Ukrainian IT developer market demand, as the number of open positions has dropped from 28 000 pre-war to 12 000 vacancies at the moment and a 23% drop in the overall workload.6 Despite that, 77% of the Ukrainian companies have managed to retain their relationships with their clients without decreasing the volume of business.7

Unfortunately, we’ve seen firsthand that most clients feel that using Ukrainian IT professionals is too risky at the moment. There are some clients that show also solidarity towards Ukrainian software service companies and believe that companies can operate despite the war, but these clients are unfortunately more of an exception.

11. IT talent shortage

I’ve written about IT talent shortage quite a bit in the previous two articles, so the only issue I underline here is a repeat of the previous one: there aren’t enough IT professionals to meet the demand. And as the price inflation of IT continues at an alarming rate, many unwanted side effects come along with it.

Due to talent shortage and further specialization in certain areas, the IT talent market is today truly global and the regional differences in the salary levels continue to shrink. For companies buying IT development services, a hunt for huge cost savings by finding developers from other countries makes less sense than some years earlier. However, this doesn’t mean that Eastern Europe as a region won’t continue to hold value to customers. Some of the key benefits of this area in addition to lower costs are:

- Outsourcing experience – long experience in the international outsourcing business and most companies are focused specifically on foreign markets

- Strong remote working culture – even prior to Covid-19, software developers were accustomed to working in distributed teams

- Highly skilled IT professionals – exceptional talent and know-how as a result of a long educational history focused on math and science

- High work morale – value-driven individuals with a strong work ethic

- High English proficiency – the region possesses one of the best commands of the foreign language on a global level29

There has been some consolidation in the Eastern European IT market, where professional services companies have merged or have been acquired recently. Western companies are looking for companies to acquire, but are not finding it easy, because of the small number of suitable acquisition targets and the growing valuations. Valuations in some of the transactions have been completed using a multiplier of 3-5 of annual revenue.3, 6, 12, 13, 18, 20, 26

All this being said, we at East are also seeing signals of a slight calming in the market.

Read ahead, more about that in the next section.

12. Global economics and geopolitics

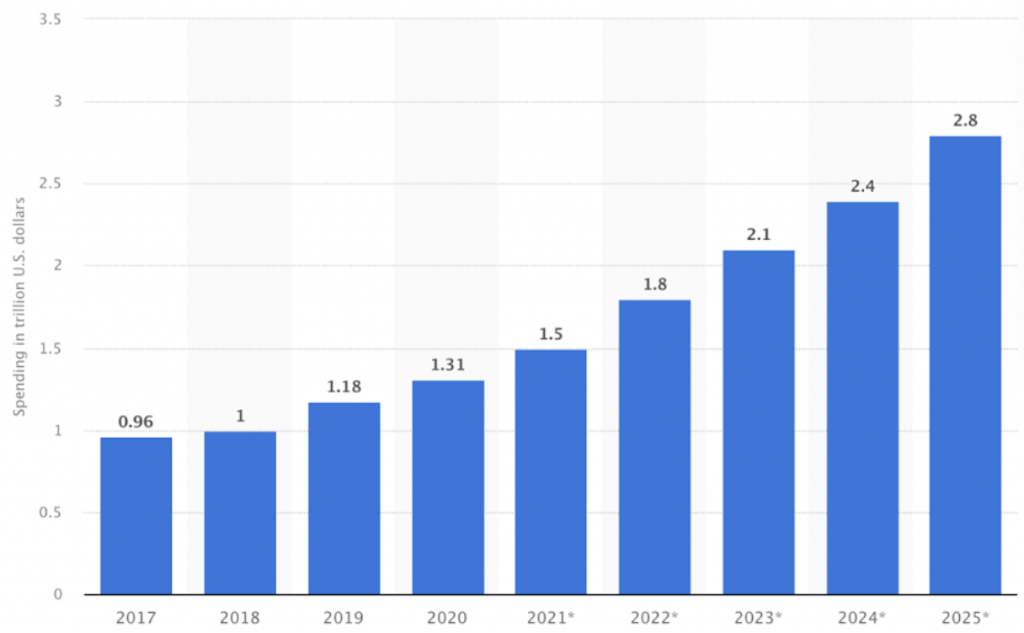

The IT industry has always been impacted by the global economy, following trends in economic health and the availability of funding. At the beginning of Covid-19, we saw a momentary slump in IT talent demand, resulting from global economic uncertainty. After Covid-19, the bounce back in demand was stronger than before (Figure 1). Companies’ investments in digitalization grew despite the economic uncertainty, or partially because of it.

Figure 1. Spending on digital transformation technologies and services worldwide from 2017 to 2025 (in trillion U.S. dollars)

(Statista 2021)

We are seeing similar uncertainty as a result of the Ukrainian war. Some clients are looking at the entire Eastern Europe through a new political lens. This is more pronounced with the US companies that tend to clump Eastern Europe (or Europe as a whole) into one area. After all, many purchase decisions are not based on careful research of the area, but rather on intuition and a lack of understanding of geopolitics.

13. Wakeup: Halt on crazy IT talent salary inflation

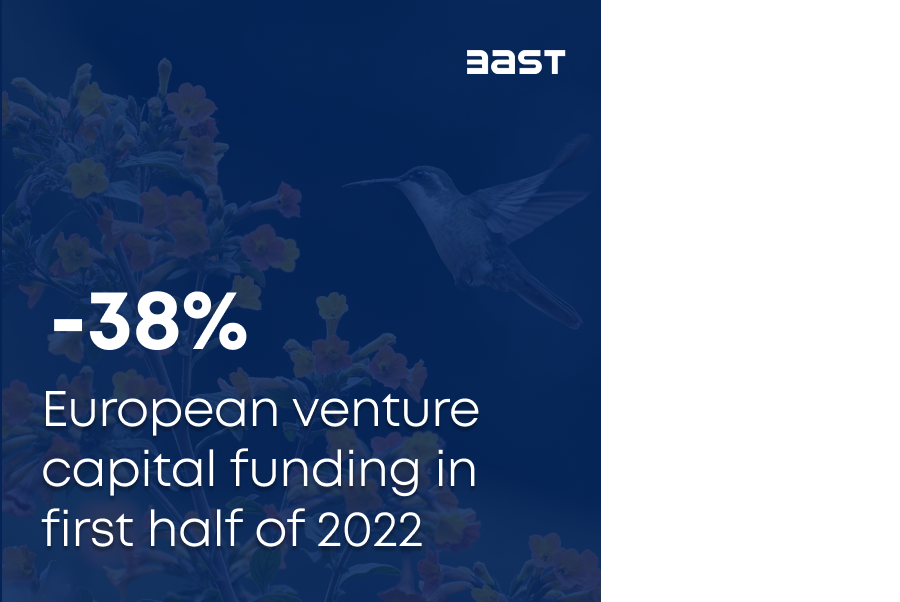

Venture capital funding has decreased significantly this year, with Europe reporting a 38% drop for the first half of 2022.23 As scaleups are major drivers in IT developers’ salary inflation, this can have double the impact on market price levels. Even well-funded scaleups have recently announced cost cuts in order to lengthen their runway. Startups and scaleups looking for their early funding rounds are even more in a pickle.

And of course, the hike in central banks’ interest levels will increase the price of money also for more mature companies. This easily leads to companies cutting projects that are geared toward future innovations and new revenue streams.

We’ve seen the slump in demand firsthand – it has been slightly easier to find IT talent and software development teams now than it was at the end of 2021, and client decision-making times have gotten longer. How long this slight drop in demand continues, and how deep it will go, I will not start speculating.

This cooling will have an effect on developer salary levels in markets around the world. I expect the top salaries that some of the scaleups have been paying even in the IT nearshoring markets, sometimes at levels above 10,000 €/month, will become rarer. We are keeping a very close eye on this trend and will most probably publish some more on the topic towards the end of this year.

The US market has normally led the way, so here are a couple of interesting views from the American tech employment market:

What the hell is happening in the Tech Industry?

Companies Have Started Firing Their Employees: Why You Need To Know About It

13. Income disparity

Looking at many Eastern European countries, the income inequality between IT talent and the rest of the labor market has grown significantly.5 A Junior JavaScript developer might earn more than a bank manager with 20 years of experience. As an example, the median salary in Poland is around 1,500 €/month, and the average software engineer salary, according to Glassdoor, is 5,200 €/month.9, 16 Don’t hang me on these numbers, as available salary statistics are all over the place, but this should still give a pretty good indication of the size of the difference.

The income disparity is now so large that it can no longer be ignored. Every politician understands that this is the type of talent you don’t want to lose, but on the other hand, it’s becoming increasingly difficult to ignore inequality.

A good example of a possible reaction is the “Polish deal”, as it’s called — a relief for lower and middle-income families, with a proper tax hike for the higher income brackets, that came into force at the beginning of 2022.1, 8, 14, 15 This kind of increase is not very likely to push people to leave Poland, but a part of it will be transferred to sales prices and salaries over the next two years. I think we can expect similar changes in many other Eastern European countries.

14. New IT nearshoring destinations

Southern European countries like Spain and Portugal, have had more modest salary inflation compared to Eastern Europe and farther offshoring markets such as India. As a result, they have increased their appeal to customers looking for perceived cost savings in software developers’ hourly rates.

Many Southern European countries have a big home market demand and the language level tends to be worse than in Eastern Europe. But in many cases, the price per hour for development work might be one-third cheaper than in Eastern Europe.

Eastern Europe is having a heyday still, but the competitiveness in prices has radically worsened in just the last two years.

15. More emphasis on cybersecurity

The Ukrainian war has further increased the awareness of cyber threats and cyber warfare. As software becomes more complex and relies more and more on open-source software, auditing software projects has become even more important.

The Ukrainian war has further increased the awareness of cyber threats and cyber warfare. As software becomes more complex and relies more and more on open-source software, auditing software projects has become even more important.

Open-source security analysis shows that 84% of software included at least one security vulnerability, with an average of 158 per codebase.22 Companies have started taking these vulnerabilities more seriously, but we are still in the very early stages. However, very few IT projects are properly audited for security.

16. The IT industry in 2022 and beyond

There are tons of potential black swans (more about this theory can be found in “The Black Swan: Second Edition: The Impact of the Highly Improbable”) ranging from another viral outbreak, worldwide recession, energy crises, and risk of civil war in the US (an excellent book on the topic “How civil wars start and how to prevent them”) to more outlandish but possible worldwide internet problems resulting from solar flares. All of these can have a big impact on worldwide IT services demand.

However, most of the changes in IT are incremental or evolutionary, and I’d like to highlight 3 areas that have the potential to reach a “tipping point” which will lead to their explosive growth.

Increased move towards SaaS, PaaS, and improved code re-usability aka demand for higher value over evaluating pure development price per hour

The more the buyers gain experience in buying software development, the more they understand that the same outcome can be reached in many different ways, and they put more emphasis on the true cost of development and maintenance. Cheaply built tends to become very expensive.

This means that nearshoring and offshoring companies should provide more consulting services in order to plan what needs to be built and how to execute it efficiently. To help clients navigate the transfer from business drivers to technology, building competencies in service design becomes more important – a segment that is hugely underrepresented in nearshoring countries. Most people that I talk to service design about still see it as UX and user experience design, which it is not.

For anyone looking to increase their value add, I warmly recommend the “Value Proposition Design: How to Create Products and Services Customers Want”.

SaaS segment spending is growing at roughly double the pace of traditional software development and this is the reason why we see big platforms like Salesforce, various ERP ecosystems, and low-code platforms gaining more popularity.27

Microservices

Ten years ago, one of the industry’s hot topics was the usage of ready-made software components. This has been realized by the growing use of open-source software but hasn’t fully lived up to its promise in terms of creating marketplaces and commercial offerings on software components. I believe this is mostly due to the greatly increased diversity of different languages and environments and partly due to technical leadership having most of the control over technology selections.

As more and more companies move towards microservices and cloud-based architectures, it also makes it easier to use existing microservices and API offerings. This can greatly reduce the required development work when implemented correctly.

Faster coding, better tooling, and AI

The developer role is not disappearing, but how the job gets done will be changing a lot in the coming years. And if we see a bigger recession, pressure coming from the clients will increase the adoption of new generation tools.

Step 1— Better tooling

We already have these, but some accelerants are still hugely underutilized

Modern code editors (IDEs) have provided a way to autocomplete code for a long time already and no professional developer can live without this functionality. The difference between working with a modern IDE and an editor without auto-completion is greatly increased productivity. With a modern IDE, the developer starts writing code, and the code editor will suggest options for completing the function or line of code. This prevents errors, reduces the time the developer needs to check for things from elsewhere in the code, and increases the per-character output.

There are also tons of software that create boilerplate code from data models. These are mainly used to create CRUD (create, read, update, delete) interfaces, APIs, test boilerplate, and more.hey can greatly speed up the first phase of development, making it possible to create admin panels and prototypes in hours instead of days or weeks. And with the right tools, they can be used for more than just prototyping and proofs-of-concept. As an example, an admin panel with the exact same functionality can be built either within hours or within a few months. My question is: how much longer are clients willing to pay for the “few months” option?

Step 2 — Developer tools based on data and machine learning (ML)

Almost there

The next step from this is GitHub’s Copilot tool which uses the entire public code base of GitHub to suggest not just a function name or a line, but an entire code segment, based on the context of the code written. The functionality is based on a powerful machine-learning algorithm and can easily double the output. Of course, development is much more than just crunching out lines of code, but at the heart of it, writing individual lines of code is still the majority of the work hours. Another interesting developer tool to keep an eye on is Tabnine, providing similar functionality.

Step 3 — Application generators leveraging machine learning and natural language descriptions

Future promises, some early phase commercial offerings already

There are already tools (Arria, Clickvoyant, etc.) for generating entire application structures and a big portion of the code is based on pseudocode which is closer to natural language.

These tools are still fairly rudimentary and are not used much, but software within this space does have the potential to grow into true technological disruption. A tool that would become popular could reduce the number of lines written for any specific need by a factor of two or three. Productivity improvement of two to three times across the industry would start having a big impact. What if you needed two developers instead of six? This would affect worldwide demand for software development, and companies adopting automated code generation tools early would have a head start in the competition.

This might be in years’ time or it might happen much sooner. All it takes is one software to really breakthrough. Here are a few interesting examples of segments and individual software products:

- Tools generating HTML from hand-drawn sketches with AI – Sketch2Code.

- AI-powered testing tools – AI test automation tools are examples of some of the most mature and usable software development and release management aids. Check out tools like Autify, SmartBear, and Functioinize.

- Data tools – Data engineering and data science have always walked hand-in-hand with machine learning and AI. API offerings in this area make utilizing services a breeze for developers. Want to know whether an individual comment is positive, neutral, or negative? Ask an API.

- Automated code generation – These tools are still more for academic use, but it shouldn’t take long before we start seeing real-world commercial offerings.

17. Takeaways

Whether the market for technology services is in a bear or a bull market, East can help both software development vendors and client organizations. We are also happy to discuss the micro and macro movements of the market. We believe these discussions are interesting learnings for both, so don’t hesitate to reach out.

4 key takeaways and business opportunities for software development service providers

- Service design and business IT consulting – Invest in service design and business IT consulting services, which are closer to traditional enterprise offerings and focus more on value and what needs to be developed as opposed to how something should be developed.

- Cybersecurity – Invest in services around cybersecurity, code auditing, and security analysis.

- Automated code generation – Research and adopt tools to radically speed up development – no-code, low-code, automated code generation, and different kinds of code generation aids.

- SaaS ecosystems – Understand the alternatives better and evaluate SaaS software ecosystems that have gained good traction and which can accelerate your business.

4 key takeaways for the client organizations

- Software development tools – Pay more attention to what kind of tools are used for building software.

- Software development productivity – Evaluate and measure software development output. Here is a great listing of tools that can help you with that.

- Microservices and SaaS solutions – Research alternatives for the “develop from scratch” approach: no-code, low-code, microservices, and tailored SaaS solutions.

- Outsource for higher value – Approach hiring and outsourcing more from a value perspective instead of pure price per hour.

I’m a creative builder with over 25 years of experience in the IT industry. I understand the customer’s real needs and their operating environments, which allows me to find and connect the most technically and culturally most suitable experts with companies that need the best IT talent.

I currently aid Nordic companies to source talent from Eastern Europe and set up processes to improve the efficiency and success rate of IT offshoring and nearshoring ventures. I’ve gained my experience in Eastern Europe by living in Bulgaria for years and working with Eastern European IT talents over a decade.

Follow me and East on LinkedIn to stay updated about new articles.