Thank you for all the great comments in part #1 — we welcome you to continue the discussion for part #2!

What we covered in part #1:

-

-

- Increase in IT nearshoring and offshoring demand continues to grow

- The talent shortage is the biggest problem for the IT industry at the moment

- Changing the personal motivation of developers and other IT professionals

- 20 ideas for mitigating some of the resulting problems

- a. Surviving the salary inflation

-

-

- b. Tackling churn and recruitment challenges

-

-

-

- c. Addressing talent motivation problems

-

-

-

- d. Professional skills development

-

-

- e. More efficient sourcing

-

What you will find in this part #2:

-

- Increased vendor leverage of IT software developers

- Nearshoring IT vendors are moving away from being subcontractors

- Lack of transparency and dishonesty of some software vendors

- In-sourcing and better technical know-how of customers

- Transformation of the IT project manager role and increased pressure in being communicative for developers

Part #3 (coming soon):

-

- Macroeconomic drives and changes

- Possible black swans — aka. Expect the unexpected and mitigate

- Summary

The IT nearshoring industry’s move from a “sales problem” to a “supply problem” in a very short time results in many changes in the roles of the parties.

Clients can no longer dictate the rules if they want to secure top tech talent. As IT vendors have more leverage, they should also be careful not to misuse their power and create distrust toward clients. The first-come-first-served principle in terms of hiring talent is understandable, but also leads clients to see vendor companies as nothing more than “resource outlets”. The grand talk about forming deeper partnerships, understanding the client’s business problem, and capability to take over critical business functions is severely watered down when clients are forced to act on a trigger, sometimes requiring to confirm hires in hours, not even days. Software service companies that act purely as resource providers have much less value-add and are thus more easily replaced.

5. Increased vendor leverage of IT software developers

In just a few years the entire IT market has taken a 180° turn from a “sales problem” to a “supply problem”, which is even more accentuated in the nearshoring business. Unfortunately, sometimes we humans are a little petty — meaning that some on the IT vendor side have not forgotten how harshly they’ve been treated by clients in the past — unreasonable decision times, completely unfair contract terms, etc. which combined with the market-wide supply problem, means that most vendors work with the “take it or leave it” approach when it comes to contract terms and staffing. This pushes clients for radically shorter decision-making timelines.

At East, we’ve seen several cases in 2021 where weeks, two days, or even hours in decision-making resulted in IT talent being assigned to another client. It’s a “first come, first served” principle even for big, sexy brands with interesting ventures. This principle applies to big and small software vendors alike.

The 8 best ways to mitigate the issues from vendor leverage for clients are:

-

- Contracts – Making sure that contracts towards providers are simplified, better structured, and fairer. For example, at East, we can rarely get vendors to sign big companies’ standard frame agreements “as is”.

- Decision making – Making sure that the organization is ready to make the decisions fast, and approaching nearshoring vendors only when the budgeting decisions have been made.

- Payment terms – Re-evaluating general payment terms, and making sure vendors are paid on time. There are also big differences between countries; in the Nordic countries, 20-60 day payment terms are fairly common, whereas 7-14 days are the norm in Eastern Europe. 60 days mean that the vendor needs to pay salaries for three months before getting paid and that’s often a tall ask.

- Budget – Double-check the budget expectations and be able to adjust on the fly if the situation demands it.

- Project duration – Long-term contracts make the deals more interesting for the vendors and also help control the cost better. Having short contracts might feel like better security, but it also increases the risk of price inflation.

- Venture marketing – Put more effort into marketing the ventures and projects themselves; individual developers have more and more say on which projects they want to work in. Requests without proper job descriptions simply don’t get the same attention as well-described needs.

- Team culture – Invest more in team culture, good working practices, and inclusive culture that sees external developers as part of the internal team.

- Acting fast – This can’t be stressed enough — once you are ready to start hiring, be prepared to move forward in days. Collecting potential tech talent candidates three weeks in advance is useless. IT talent simply will not be available after three weeks if they are free now.

6. Nearshoring IT vendors are moving away from being subcontractors

In markets like Eastern Europe, where software development companies have traditionally worked mostly as subcontractors (aka tier-2 or tier-3 providers), the setup is fast changing. Whereas before there hasn’t been enough trust for companies to work with nearshoring vendors directly, the lack of tech talent and increasing prices have made client companies re-evaluate their approach and the need for a local software development provider. This combined with nearshoring vendors’ increased know-how on both end-to-end implementation and client relationship management, the shared frustration of multi-step communications, often resulting in a broken phone effect, and price squeezing applied by tier-1 vendors, are making direct client relationships much more attractive and attainable for nearshoring vendors.

For companies that haven’t worked as tier-1 providers before, the move from being a tier-2 or tier-3 provider might be bigger than anticipated and the learning might show up as certain immaturity in dealings with the clients. World-class technical talent alone is not enough. We at East are also happy to help our vendor partners in this transition if nothing else, acting as a sounding board and devil’s advocate for your strategy and vision.

The vendors’ increased ambition and appetite for direct client relationships increase the difficulty for tier-1 and tier-2 vendors to find and attract subcontracting talent. In the current market situation, founding a local company or acquiring a local vendor from one of the nearshoring markets is also moving out of reach — recruiting for a company without a solid reputation in the nearshoring market and without real experience in the market is extremely difficult. Valuations for IT software companies have escaped from within reach in many cases, the financial equation is not working well at the moment. We’ve seen IT service provider companies valued at many times their annual revenue.

7. Lack of transparency and dishonesty of some software vendors

All business is based on trust and nothing erodes it like dishonesty. I’m sad that I had to include this topic on the list of current market trends. Just to give you an idea, I’ll share a few anonymous examples from the “trenches” of what we saw at East during 2021.

Unfortunately, we’ve had to stop working with a few IT vendors because of dishonesty in their dealings with the client and us. And all these cases could’ve been avoided with transparent communication. Dishonesty means broken trust and it’s disastrous for companies’ reputations.

A common trend is to continue negotiations with several clients at the same time. When clients are scouting for talent, they should be prepared that they are not the only customer currently interested. I think this in itself is more of an inconvenience rather than being dishonest, as long as it’s clearly communicated. Going incommunicado and outright lying about what’s going on is too clear an example of a company’s general culture in regard to honesty and transparency.

Claiming employees to be their own when in fact they are contractors. Increased chaining of IT business leads to setups that are more muddled in terms of who is the actual employer and what providers are involved. As an example, when it becomes clear that there is a need for a background check due to the confidential nature of the work, the client’s contract terms all of sudden become “unreasonable” or “impossible to agree with” or the vendor finds another way to weasel out from the contract without seemingly losing face. The contract chaining makes it also harder to synchronize all the contract terms and confidentiality.

The clear intention of switching senior tech talent during the contract term using excuses. Unfortunately, some companies have taken a habit of selling with a pool of senior IT talent that then gets changed during the contract term. It is possible to agree with the client on a smooth transition, and often it’s beneficial to the client to have several people being familiar with the project. And if the vendor is willing to put some extra effort into a smooth handover without extra cost for the client, this can be a good thing. But the intention should be communicated already before signing the contract.

Software developers are assigned with 100% allocation to one client and in reality working also for another client (often with 50% allocation, but we’ve also heard of cases where there is a full double allocation). This is simply fraudulent, but unfortunately does happen, though very rarely on the Eastern European market where we find the general morale being much higher than in some other countries where we also have been working in.

Overprotecting business by violating employee rights. This is not always obvious on the surface. We’ve seen a very reputable IT company which is highly regarded as a good employer, suggest making deals that limit seriously all of their employees’ inherent right to become entrepreneurs and sell to businesses this company works with. Something like this earns a place on our blacklist right away, not to mention that it’s illegal and can result in all companies signing such contracts being fined 10% of their annual revenue.

Luckily these examples are exceptions on the market, but what is worrying is that we’ve seen these happen with both small and large software providers, hinting at poor corporate responsibility and opportunism. We are very lucky to work mainly with the Eastern European and Nordic markets where corporate and employee responsibility, in general, is higher than in many other markets. Part of East’s value proposition is to prevent these problems from surfacing in the first place by working with trusted and evaluated software development partners and IT vendors and increasing overall transparency.

All these “growing pains”, I hope and believe, will lead to one of the biggest and most positive impacts within the IT industry — transparency becoming a core company value for more IT vendors.

At first glance, foxes seem so cute, clever, and playful – they are, but on the other hand, foxes are also known to be malicious animals driven by their own interests. Looks can be deceiving. As a client and as a service provider you have to be careful when dealing with new people. Honest and transparent communication creates trust, and without trust, there can’t be a good, lasting partnership. 8. In-sourcing and better technical know-how of customers

In-sourcing and outsourcing software development tend to go in cycles. Currently, we are riding a big in-sourcing wave, where client companies try to attract as much technical talent as possible. The biggest drivers to this are increased business criticality of IT and the difficulty in coordinating multi-vendor projects that have become the norm due to talent shortage. This leads to viewing external IT providers more as a pool to augment the existing talent.

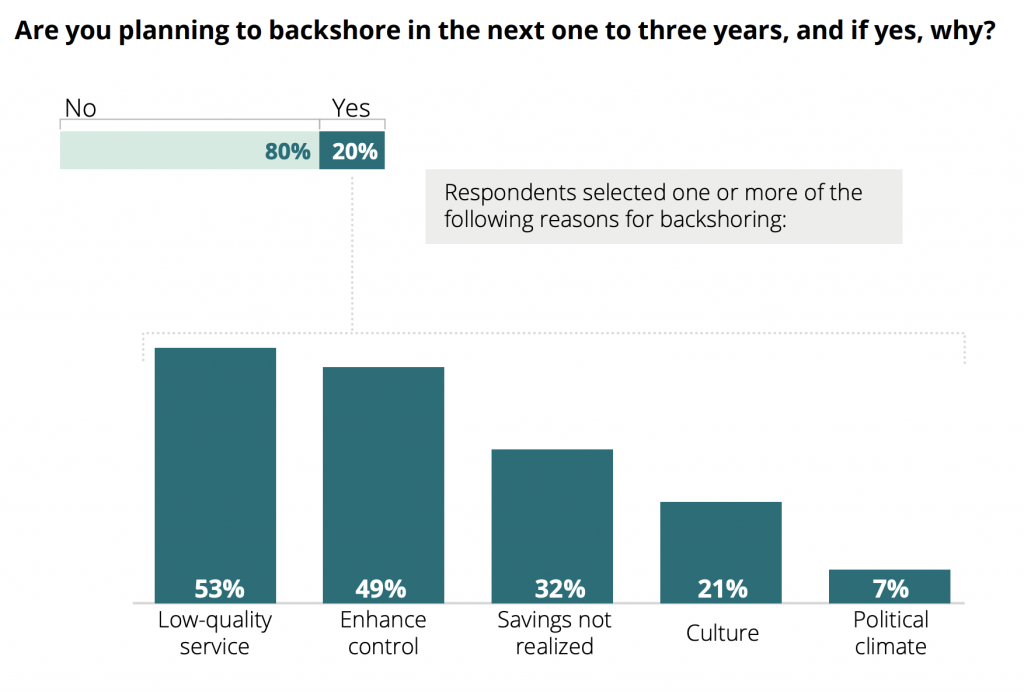

According to Deloitte’s 2021 Global Shared Services and Outsourcing Survey report, 20% of companies plan to backshore for various reasons, the main drivers being concerns about quality and control. The great thing about this cycle of in-sourcing is that clients are able to evaluate and manage technical talent, reducing the risk of unmet expectations on both sides. More and more of the clients are expert buyers who also read the market well — they understand the time criticality in hiring, build motivation for developers and make sure of the fair and equal treatment of everyone.

When the market is more about augmentation, IT vendor organizations have less focus on building value-add beyond sourcing. In order to ease the pressure in a tech talent shortage, I believe vendor organizations should be constantly innovating on how to do things better, how to differentiate from the competition, and how to provide solutions that are not about developing everything from the beginning — whether the solutions come in the form of using ready-made software, rapid application development tools or share code libraries. Most probably we will see a big change in the ways of working only when the market takes a turn downwards.

My prediction for the next two years is that more and more software developers will leave vendor organizations to form collectives or companies where the profits are shared more equally. This was not as feasible before, since closing a sale was more connected to the reputation of the vendor company. This hurts vendors double, as the people leaving are usually the most driven and talented.

9. Transformation of the IT project manager role and increased pressure in being communicative for developers

To satirize a little, in the past, IT project managers held the keys to client communications, and client relationship management and developers were safely tucked away, out of sight. Change in these roles is maybe not quite as sudden as many other trends listed in this article, but important to recognize, as they have a big impact on team dynamics and job satisfaction.

Everyone and their mother is working with some kind of Scrum or Kanban framework. One outcome of this change is very clear — there is decreased demand for traditional IT project managers and increased demand for Scrum Masters, product owners, and technical product owners. Many people who used to work in project management are moving closer to business.

IT Jobs watch statistics show that job ads for the title Scrum Master have seen a quick growth within the last ten years whereas the number of job ads for IT Project Managers has been increasing much slower. Scrum Masters’ big salary also indicates growing demand for this role. In UK (excluding London), the median annual salary for Scrum Master is £57,500 and for IT Project Manager, £50,500.

In addition, the requirement for communication and other soft skills for software developers has increased considerably. Developers work more often directly as part of a distributed team or with the business stakeholders. In general, the border between client and IT vendor organizations is becoming less defined.

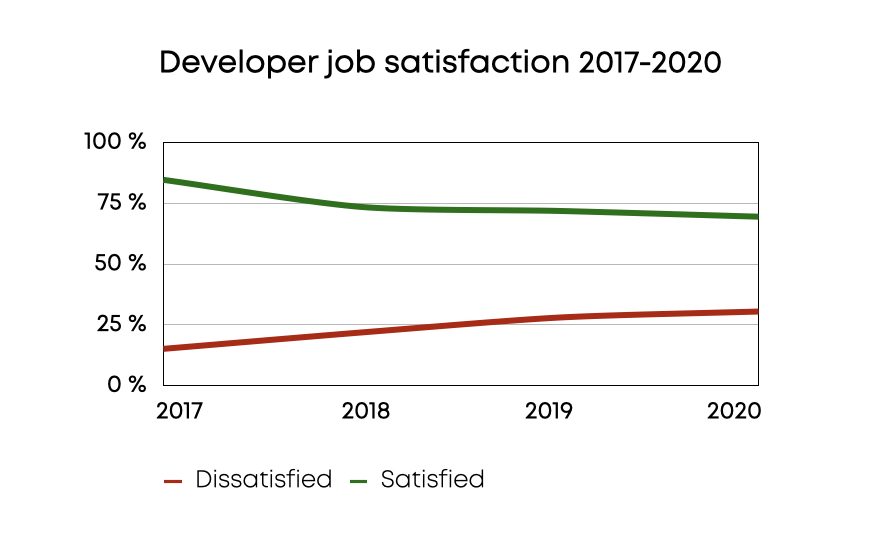

Combining data from Stack overflow’s surveys from 2017 to 2020 shows that developers’ job satisfaction is decreasing quite fast. This is a worrying development and I believe partly connected to the changing role of developers in general. Change from traditional IT project management brings a lot of positives in removing multistep communications and avoiding the “broken phone” effect in communications between the client and developers, but unfortunately, it also increases stress and thus can lead to decreased productivity. Being an introverted personality myself and having done a lot of software development, I’ve seen firsthand how detrimental increased communications and social interruptions can be to my own coding productivity and job satisfaction. And in a distributed working setup recognizing problems relating to this requires exceptional sensitivity from the managers.

The best ways to mitigate problems resulting from the increased social pressure are continuous job satisfaction monitoring, the effort made into understanding each team member’s personality, and closely following team velocity. The role of a Scrum Master is not just about arranging tasks, it’s about removing obstacles and championing ways to maintain and increase motivation and satisfaction.

Thank you for getting this far, whether you read or skimmed. Part #1 received some excellent additional perspectives, thank you very much for those everyone! As this is maybe a more opinionated piece, it would be nice to hear voices from some opponents also. Stay tuned for part #3, which is more of a macro view. Follow on LinkedIn to get a ping on the last part of this series.

I’m a creative builder with over 25 years of experience in the IT industry. I understand the customer’s real needs and their operating environments, which allows me to find and connect the most technically and culturally most suitable experts with companies that need the best IT talent.

I currently aid Nordic companies to source talent from Eastern Europe and set up processes to improve the efficiency and success rate of IT offshoring and nearshoring ventures. I’ve gained my experience in Eastern Europe by living in Bulgaria for years and working with Eastern European IT talents over a decade.