Overall, 2022 was a strong year for the Eastern European IT industry, where the median turnover growth of respondents was 33% and the median profit margin was at 17%.

We surveyed some of our IT outsourcing partners from Eastern Europe about how 2022 went and what the expectations were in January 2023. In this blog article, we are sharing here some snapshots of this data. The full report is available only to companies who responded to the survey, so make sure to respond end of 2023 if you missed it this time.

To put the current situation in the market into perspective, it’s very good to look at how strong the year 2022 was. As an industry, we are suffering a “hangover from the big party”. From the surveyed companies, we saw a 33% median growth and a 17% profit margin.

On the downside, tech talent salary inflation in 2022 continued to grow, and individual expectations in terms of financial compensation are, in part, unrealistically high at the moment.

As outlined in our 2022 Market Report (download the eBook here), the expectations have largely been driven by product companies that pay higher-than-average salaries. A huge drop in VC investments is affecting the number of available tech positions and the compensation levels. I’m not going deeper into this, as it’s widely covered in the eBook.

A lot of the optimism that was still apparent in December 2022 and January 2023 is now melting away at a good clip. Despite the strong financial year 2022 in the Eastern European IT nearshoring market, it’s good to keep in mind how vulnerable IT service provider companies are to market fluctuations. For example, a 15% drop in demand, especially when combined with increased price pressure, means negative profit for the year if the costs remain the same. The survey revealed that companies expect salary inflation to remain high, so this equation is not peachy.

And here is the catch: if a market dip is predicted to be more of a bump than a longer-lasting bear market, companies would rather keep people on the bench and eat the profits. Those that expect this to be a prolonged period will start laying off at a faster rate.

What’s happening in the Eastern European IT nearshoring market?

Already in early 2022, we were forecasting a market downturn to happen at the end of 2022. Despite a surprisingly strong January and February this year, this “real” downturn is clearly now being realized.

This survey was conducted in January 2023 and includes qualified responses from 36 companies. Many of the respondents noted the market movements with increased mergers and acquisitions. There are many companies both in Eastern Europe and outside seeking acquisition targets, especially companies with 50 to 100 IT experts.

Market observations

These observations are based on various discussions we’ve been having with our partner and client companies in Eastern Europe and the Nordics.

The Nordics

- Nordic markets are more careful than opportunistic in times of financial turmoil.

And turmoil we have. 12-month Euribor was at negative the start of 2022. Today we are at almost 4%. Especially in Finland, mortgages are almost always tied directly to Euribor. Combined with inflation which is close to 10% and high energy prices it has caused a plummeting consumer confidence index, which is ticking new lows every month. - Bigger IT companies had a similarly strong year in 2022 as in Eastern Europe, but are now seeing a strong drop in demand, bigger bench, and increased price sensitivity.

This has led to price-cutting on local markets, decreasing the cost advantages from the Eastern Europe. Nordic IT companies follow the same dynamics as the Eastern European ones—eat the profits or lay off? - Decision times have gotten longer.

The year 2022 was dominated by a feeling “of missing out” when contracting—we saw decisions made in a couple of days in some cases. This is no longer the situation. Sometimes the decision timetables keep stretching to ridiculous lengths. And in other instances, the budget for projects gets suddenly pulled back. - The job market has stabilized.

It’s easier to hire, which also means that companies that have used contracting as an alternative to hiring are better positioned to find talent. - Price pressure when contracting.

We are seeing more requests where the main driver for contracting is in cutting costs. Overly inflated prices are simply not flying in the current market situation—companies that contract and hire are getting flooded with offers.

Eastern Europe

- The size of benches has grown very fast. And people are kept on hold for longer. Even very good senior talent that in 2022 would’ve been reallocated in days has been available since the beginning of the year.

- Hiring has gotten radically easier. For open positions, it’s easier to find experienced talent. At the same time, job security is again of higher value.

- Some companies are already struggling with cash flow.

- Filling the sales pipeline has gotten harder.

Companies are looking to strengthen their marketing and outreach efforts.

It’s difficult to make predictions, especially about the future, as the old Danish proverb goes, but my guidance for this year would be this:

If you see the situation as extremely bleak at the moment, it will probably be better than you expect. If you are optimistic about things, it probably means that you have been lucky enough to miss the writing on the wall, and you will have unexpected setbacks this year.

Pay attention to your cash flow and factor in clients who start to pay later. If you work with a lot of startups, pay attention to your exposure to credit risk. Cash is king—make sure you have enough of it. Nothing sets a company into a negative spiral as fast as poor cash flow.

Take good care of your people. If you need to lay people off, remember that the way you do it will be one of the most essential parts of your company’s and your own reputation for years to come.

Remember this—the strongest companies are built during a bear market. Make sure you pay attention to the following things:

- Your cost competitiveness

- Quality of services rendered

- Your value add

- Developing your skills

Overall IT nearshoring market outlook

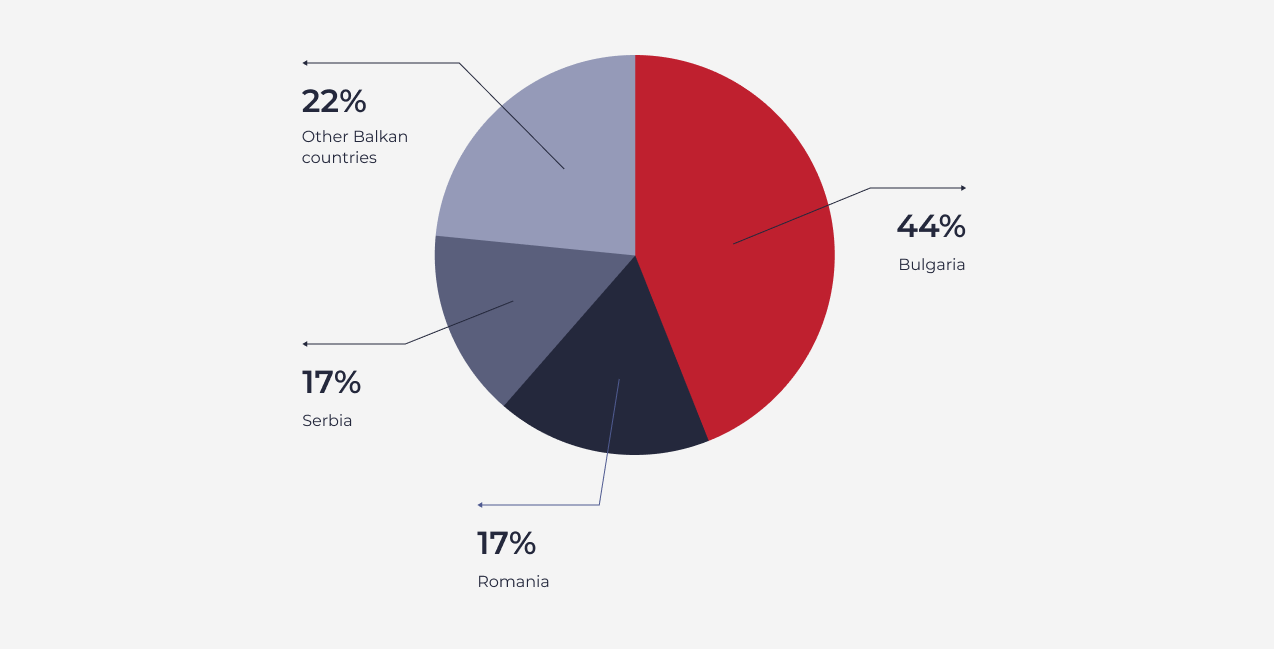

Eastern European IT survey respondent countries

Bulgaria, Romania, Serbia, and other Eastern European countries

Eastern European IT companies’ top three target markets

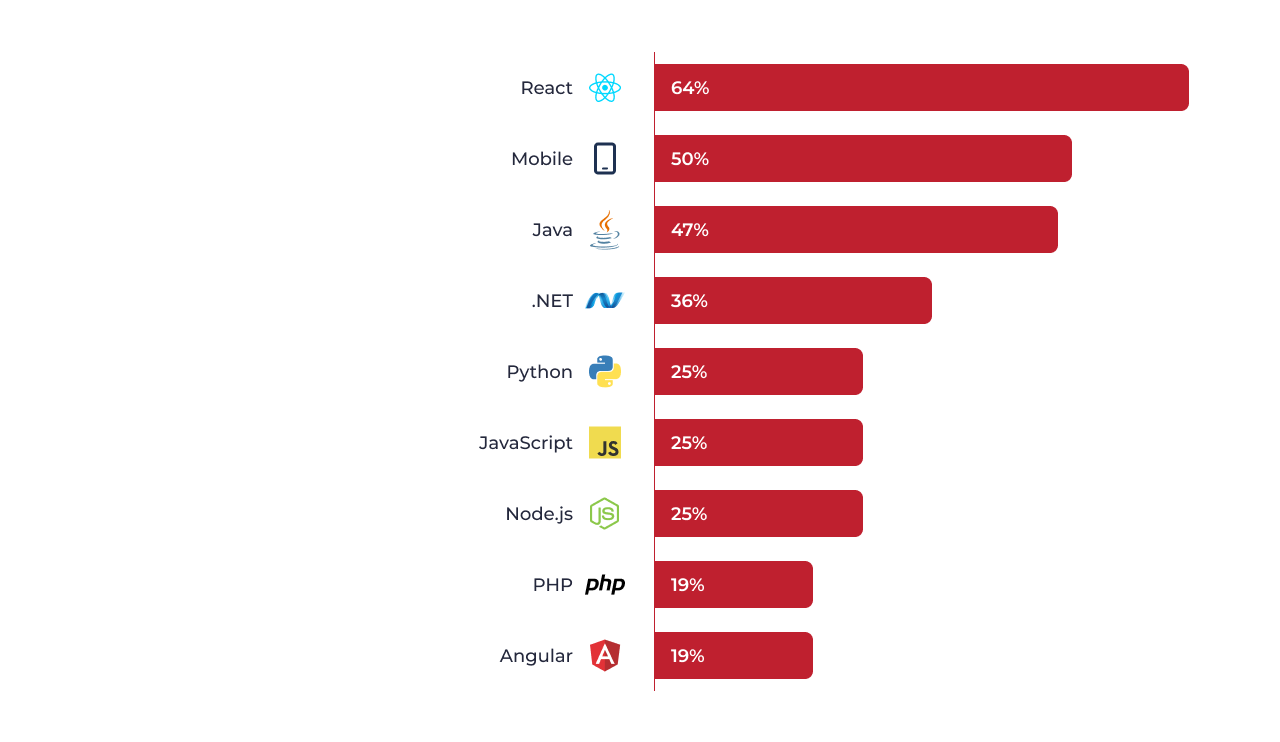

Most popular technologies among Eastern European IT companies

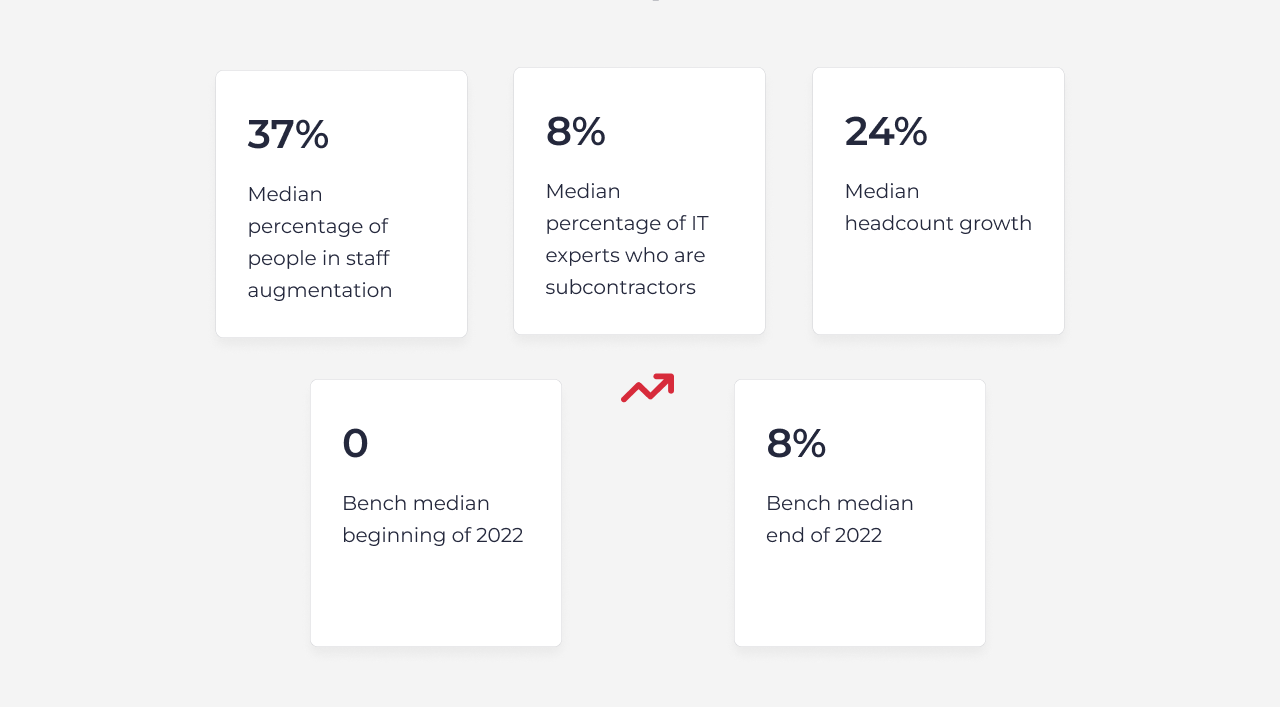

Eastern European IT – Human Resource data

Eastern European IT companies’ preferred methods for acquiring new clients

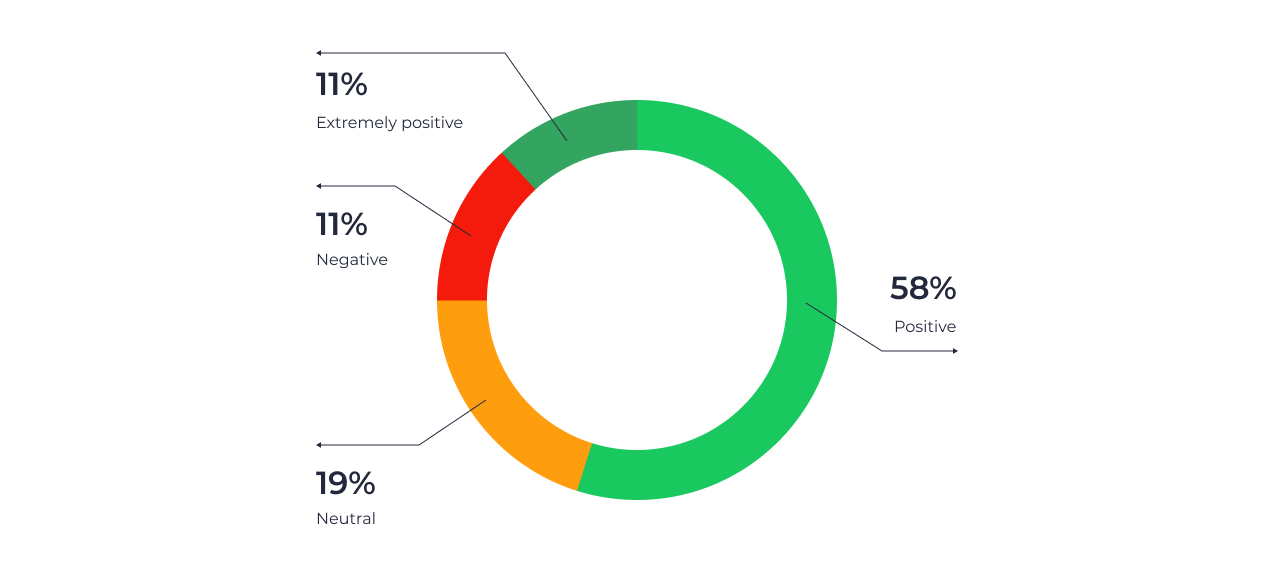

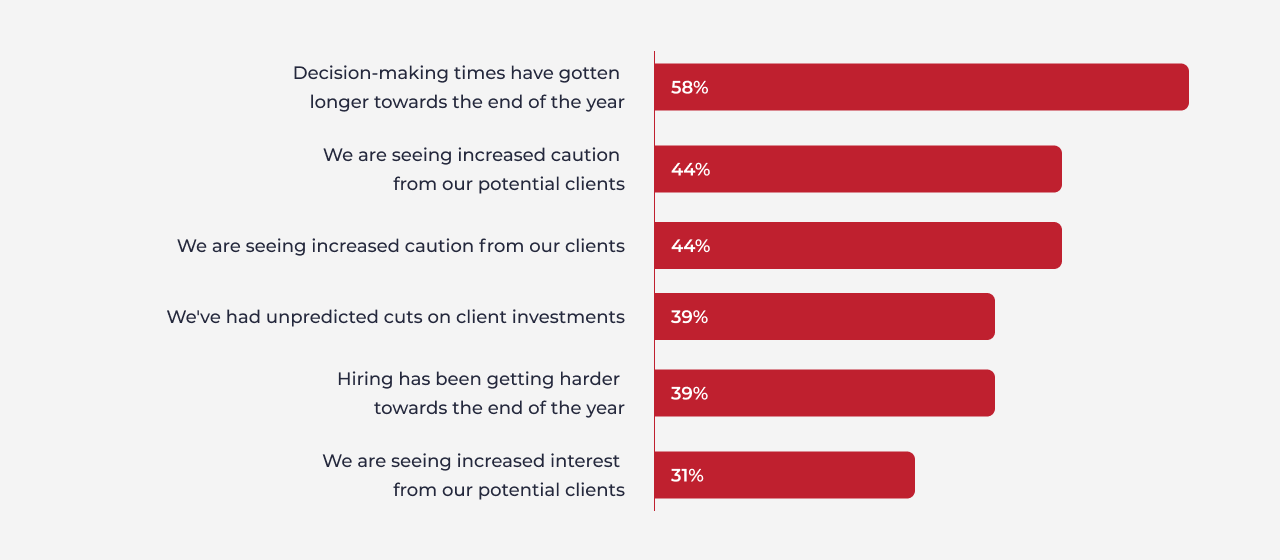

Eastern European IT companies market outlook for 2023

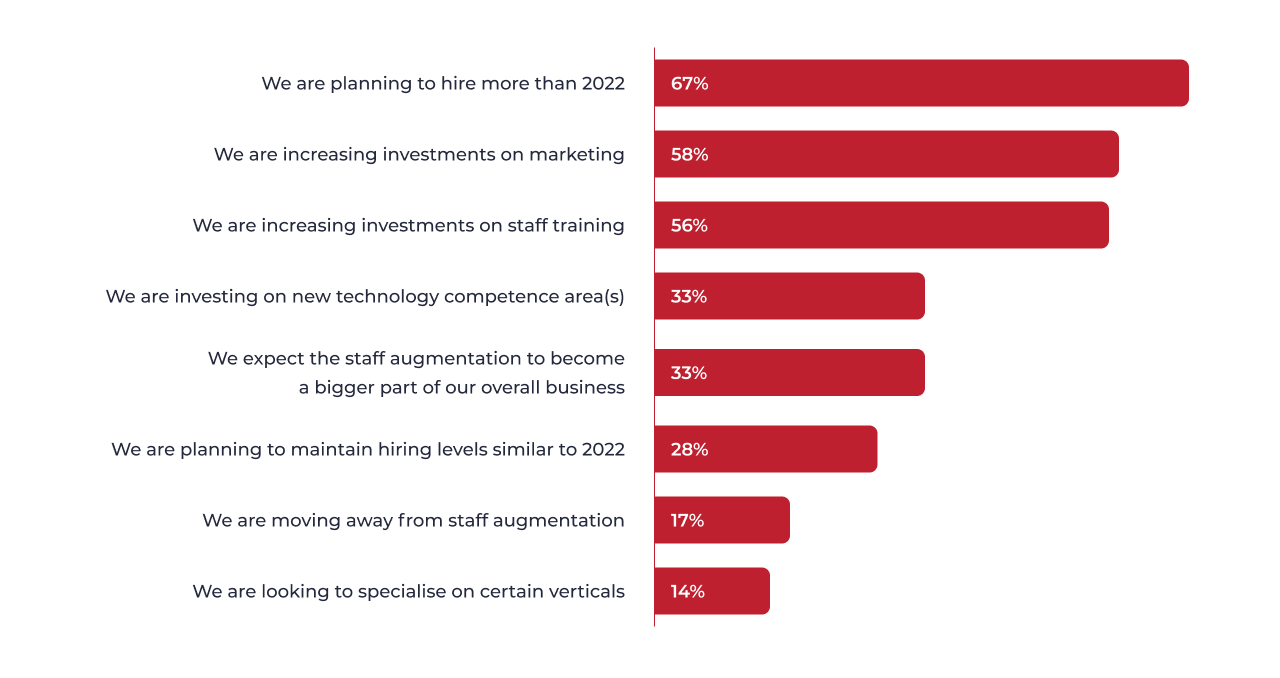

Eastern European IT companies’ direction for 2023

Software development companies’ biggest obstacles for growth

I’m a creative builder with over 25 years of experience in the IT industry. I understand the customer’s real needs and their operating environments, which allows me to find and connect the most technically and culturally most suitable experts with companies that need the best IT talent.

I currently aid Nordic companies to source talent from Eastern Europe and set up processes to improve the efficiency and success rate of IT offshoring and nearshoring ventures. I’ve gained my experience in Eastern Europe by living in Bulgaria for years and working with Eastern European IT talents over a decade.

Follow me and East on LinkedIn to stay updated about new articles.